Our Open Llc PDFs

Table of ContentsThe Greatest Guide To Open LlcAn Unbiased View of Accounting And Payroll Services9 Simple Techniques For Payroll ServicesWhat Does Accountant Near Me Mean?Things about Accountant In Florida

Are you among those small service owners who just love reading spread sheets? Me neither. Yes, your organization's books are a scorecard of how well you're doingbut if you're not a "numbers individual," doing your bookkeeping might seem as appealing as a root canal. Still, other entrepreneur indicate to go over their business finances but obtain caught up in the everyday and never navigate to it.Co-mingling expenses and revenue is a typical error in small company bookkeepingand one that will trigger massive migraines for your organization in the future. Open up a company bank account as quickly as you decide to go via with your startup, and obtain a separate business charge card. This not only divides your accounts however likewise assists your service construct its very own credit scores rating.

Use cloud-based accounting software application, and also do your organization banking online. That method, you can sync your accounting software program with your service financial institution account so you constantly have accurate, up-to-date documents.

An Unbiased View of Payroll Services

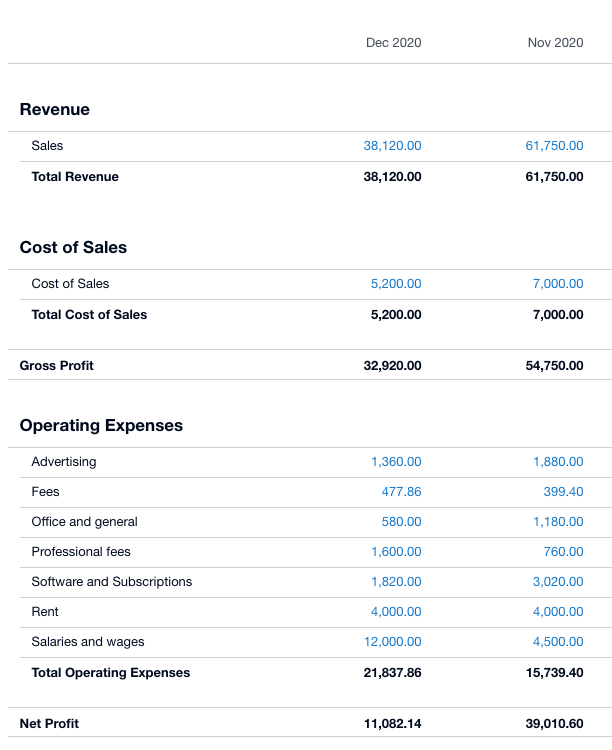

If you put off bookkeeping also long, you finish up with bounced checks, overdue billings, or numbers that do not build up. Go over your books once a week to see to it every little thing is ship-shape. At the end of each quarter, take a comprehensive take a look at your accounting and bookkeeping records. Seek trends, such as expanding or declining sales, year-over-year revenues, or an increase in late-paying customers.

Numerous modifications to the tax obligation code were made for 2018 that you must consult your accountant for assistance on what kinds of costs you can subtract next year. For anything you believe you'll be claiming, preserve detailed documents; save time by scanning and digitizing receipts. You can additionally streamline cost tracking by always making use of an organization charge card for business acquisitions.

Numerous modifications to the tax obligation code were made for 2018 that you must consult your accountant for assistance on what kinds of costs you can subtract next year. For anything you believe you'll be claiming, preserve detailed documents; save time by scanning and digitizing receipts. You can additionally streamline cost tracking by always making use of an organization charge card for business acquisitions.Choose one that works with your bookkeeping software, as well as pay-roll will certainly be a breeze, too. When clients don't pay on time, your business's cash circulation can dry out up quick.

What Does Accountant Kissimmee Do?

Even if a consumer is having economic issues, you may have the ability to establish up a payment plan to access least some of what you're owed. To stay clear of obtaining captured short, strategy in advance and also reserve cash for any kind of expected tax obligation costs. Pay in a timely manner so you do not face fines.

Rack up coaches can aid you with all elements of local business bookkeeping and bookkeeping, and also also suggest professional regional accountants. If you do not have a mentor, what are you waiting on?.

These tiny company bookkeeping ideas will aid you be successful with processing your day to day accounts and also workplace management. These pointers reveal you exactly over here how to do bookkeeping and also will raise your ability and expertise to run your business with skill. All brand-new local business owner must make it a concern to for their organization, ideally an account with online gain access to, to maintain service funds different from personal funds.

Little Known Questions About Bookkeeping & Accounting Tips.

It's even worse if you are outsourcing and paying an accountant to process your accounts with these personal expenses mixed in And also they will certainly need to be refined if they are blended with the organization transactions. open an LLC in Florida. They need to be participated in the accounting system and coded to illustrations, occupying valuable time that the bookkeeper might simply spend getting in business information.

Interest-bearing Accounts, Likewise, open an organization interest-bearing account and also reserve money from your service profits on a monthly basis to pay your quarterly tax obligation. Compute a percent (25-30%) of your Income and move it over before you invest it. Possibly do it the min your customer pays you. Online Financial Institution AccountsChecking account with online accessibility is most definitely the way to go now.

Local Business Bookkeeping Tips # 2 A sole trader or proprietor will probably take out funds from business make up personal usage (illustrations). This can be done in location of paying themselves an income (however talk to your Accountant initially). A good technique is to move one quantity often, such as when a week, from business account right into the personal account.

Local Business Bookkeeping Tips # 2 A sole trader or proprietor will probably take out funds from business make up personal usage (illustrations). This can be done in location of paying themselves an income (however talk to your Accountant initially). A good technique is to move one quantity often, such as when a week, from business account right into the personal account.The Best Guide To Small Business Bookkeeping

Business account can remain nice and neat with only organization transactions as well as the one normal illustration quantity. This will additionally prevent the temptation to designate an exclusive expense to the company. A local business owner requires to know and recognize what kind of expenses can be asserted versus the profit to reduce tax, and what can not be.

Mixing personal and business does not indicate a full insurance claim for business can be made. Sometimes the owner will use their personal funds for organization purchases.

No one can predict yet what the complete financial effect of this economic downturn will be however what we do recognize is that small service proprietors are really feeling the brunt of it currently, and also no question will certainly be affected by it in reference the future."The group at Robbins Study International have evaluated 524 organization owners and also business owners concerning their attitude - "find the top road-blocks and also the most powerful methods to overcome them".